题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The annual income of school teachers in this place

was __________ at $900.A. budgeted B. predicted C. accounted D. assessed

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

was __________ at $900.A. budgeted B. predicted C. accounted D. assessed

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“The annual income of school te…”相关的问题

更多“The annual income of school te…”相关的问题

What is the expected annual residual income of the initial investment?

A.$0

B.($270,000)

C.$162,000

D.$216,000

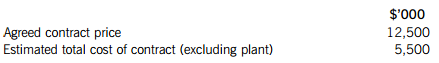

Plant for use on the contract was purchased on 1 January 2010 (three months into the contract as it was not required at the start) at a cost of $8 million. The plant has a four-year life and after two years, when the contract is complete, it will be transferred to another contract at its carrying amount. Annual depreciation is calculated using the straight-line method (assuming a nil residual value) and charged to the contract on a monthly basis at 1/12 of the annual charge.

The correctly reported income statement results for the contract for the year ended 31 March 2010 were:

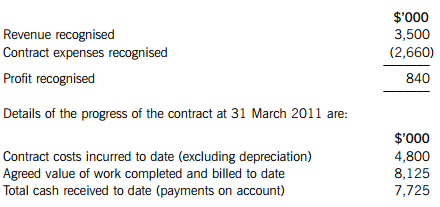

The percentage of completion is calculated as the agreed value of work completed as a percentage of the agreed contract price.

Required:

Calculate the amounts which would appear in the income statement and statement of financial position of Mocca, including the disclosure note of amounts due to/from customers, for the year ended/as at 31 March 2011 in respect of the above contract.

A、$0; $0.

B、-$200,000; +$2,000.

C、-$200,000; -$2,000.

D、+$50,000; -$500.

E、-$200,000; -$1,000.

听力原文: (30[A]) The infant mortality rate in China has declined notably since the beginning of the 1990s, according to China's new white paper on children's conditions. (29[A]) The average decrease in infant mortality in the country is 6.5 percent a year since 1990. The mortality rate of children under five years old has been tailing off by 5.85 percent annually, the white paper says. The white paper, entitled "The Situation of children in China" and issued by the Information Office of the State Council says that so far, no other country in the world with an annual per capita income approximate to China's has attained such rapid decreases.

The percentage of the annual decrease in infant mortality rate since 1990 is ______.

A.6.5

B.5.85

C.5

D.19

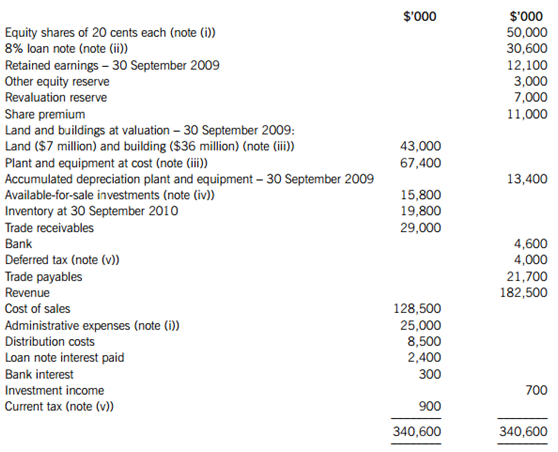

The following trial balance relates to Cavern as at 30 September 2010:

The following notes are relevant:

(i) Cavern has accounted for a fully subscribed rights issue of equity shares made on 1 April 2010 of one new share for every four in issue at 42 cents each. The company paid ordinary dividends of 3 cents per share on 30 November 2009 and 5 cents per share on 31 May 2010. The dividend payments are included in administrative expenses in the trial balance.

(ii) The 8% loan note was issued on 1 October 2008 at its nominal (face) value of $30 million. The loan note will be redeemed on 30 September 2012 at a premium which gives the loan note an effective fi nance cost of 10% per annum.

(iii) Non-current assets:

Cavern revalues its land and building at the end of each accounting year. At 30 September 2010 the relevant value to be incorporated into the fi nancial statements is $41·8 million. The building’s remaining life at the beginning of the current year (1 October 2009) was 18 years. Cavern does not make an annual transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation surplus. Ignore deferred tax on the revaluation surplus.

Plant and equipment includes an item of plant bought for $10 million on 1 October 2009 that will have a 10-year life (using straight-line depreciation with no residual value). Production using this plant involves toxic chemicals which will cause decontamination costs to be incurred at the end of its life. The present value of these costs using a discount rate of 10% at 1 October 2009 was $4 million. Cavern has not provided any amount for this future decontamination cost. All other plant and equipment is depreciated at 12·5% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 September 2010. All depreciation is charged to cost of sales.

(iv) The available-for-sale investments held at 30 September 2010 had a fair value of $13·5 million. There were no acquisitions or disposals of these investments during the year ended 30 September 2010.

(v) A provision for income tax for the year ended 30 September 2010 of $5·6 million is required. The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2009. At 30 September 2010 the tax base of Cavern’s net assets was $15 million less than their carrying amounts. The movement on deferred tax should be taken to the income statement. The income tax rate of Cavern is 25%.

Required:

(a) Prepare the statement of comprehensive income for Cavern for the year ended 30 September 2010.

(b) Prepare the statement of changes in equity for Cavern for the year ended 30 September 2010.

(c) Prepare the statement of fi nancial position of Cavern as at 30 September 2010.

Notes to the fi nancial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 11 marks

(b) 5 marks

(c) 9 marks

Ashura has been employed by Rift plc since 1 January 2013. She has also been self-employed since 1 July 2015, preparing her first accounts for the nine-month period ended 5 April 2016. The following information is available for the tax year 2015–16:

Employment

(1) During the tax year 2015–16, Ashura was paid a gross annual salary of £56,200.

(2) On 1 January 2016, Ashura personally paid two subscriptions. The first was a professional subscription of £320 paid to an HM Revenue and Customs’ (HMRC’s) approved professional body. The second was a subscription of £680 to a health club which Ashura regularly uses to meet Rift plc’s clients. Ashura was not reimbursed for the costs of either of these subscriptions by Rift plc.

(3) During the tax year 2015–16, Ashura used her private motor car for business purposes. She drove 3,400 miles in the performance of her duties for Rift plc, for which the company paid her an allowance of 55 pence per mile.

(4) During the tax year 2015–16, Ashura contributed £2,800 into Rift plc’s HMRC registered occupational pension scheme and £3,400 (gross) into a personal pension scheme.

Self-employment

(1) Ashura’s tax adjusted trading loss based on her draft accounts for the nine-month period ended 5 April 2016 is £3,300. This figure is before making any adjustments required for:

(i) Advertising expenditure of £800 incurred during January 2015. This expenditure has not been deducted in calculating the loss of £3,300.

(ii) The cost of Ashura’s office (see note (2) below).

(iii) Capital allowances.

(2) Ashura runs her business using one of the five rooms in her private house as an office. The total running costs of the house for the nine-month period ended 5 April 2016 were £4,350. No deduction has been made for the cost of the office in calculating the loss of £3,300.

(3) On 10 June 2015, Ashura purchased a laptop computer for £2,600.

On 1 July 2015, Ashura purchased a motor car for £19,200. The motor car has a emission rate of 137 grams per kilometre. During the nine-month period ended 5 April 2016, Ashura drove a total of 8,000 miles, of which 2,500 were for self-employed business journeys.

emission rate of 137 grams per kilometre. During the nine-month period ended 5 April 2016, Ashura drove a total of 8,000 miles, of which 2,500 were for self-employed business journeys.

Other information

Ashura’s total income for the previous four tax years is as follows:

Required:

(a) State TWO advantages for Ashura of choosing 5 April as her accounting date rather than a date early in the tax year such as 30 April. (2 marks)

(b) Calculate Ashura’s revised tax adjusted trading loss for the nine-month period ended 5 April 2016. (6 marks)

(c) Explain why it would not be beneficial for Ashura to claim loss relief under the provisions giving relief to a loss incurred in the early years of trade. Note: You should assume that the tax rates and allowances for the tax year 2015–16 also applied in all previous tax years. (2 marks)

(d) Assuming that Ashura claims loss relief against her total income for the tax year 2015–16, calculate her taxable income for this tax year. (5 marks)

aph in the annual report she was typing.

A)inject B)install C)invade D)insert

Economists ______ (cast) that annual increases in GDP will remain around 3 percent.

A.at

B.for

C.on

A.0.32

B.3.32

C.32.32

D.323.32