更多“什么是贴现率(Discount rate)?”相关的问题

更多“什么是贴现率(Discount rate)?”相关的问题

A.run-of-the-house-rate均价

B.rack rate 门市价

C.split rate

D.discount

Section B – TWO questions ONLY to be attempted

You have recently commenced working for Burung Co and are reviewing a four-year project which the company is considering for investment. The project is in a business activity which is very different from Burung Co’s current line of business.

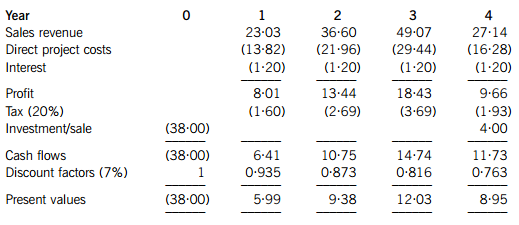

The following net present value estimate has been made for the project:

All figures are in $ million

Net present value is negative $1·65 million, and therefore the recommendation is that the project should not be accepted.

In calculating the net present value of the project, the following notes were made:

(i) Since the real cost of capital is used to discount cash flows, neither the sales revenue nor the direct project costs have been inflated. It is estimated that the inflation rate applicable to sales revenue is 8% per year and to the direct project costs is 4% per year.

(ii) The project will require an initial investment of $38 million. Of this, $16 million relates to plant and machinery, which is expected to be sold for $4 million when the project ceases, after taking any taxation and inflation impact into account.

(iii) Tax allowable depreciation is available on the plant and machinery at 50% in the first year, followed by 25% per year thereafter on a reducing balance basis. A balancing adjustment is available in the year the plant and machinery is sold. Burung Co pays 20% tax on its annual taxable profits. No tax allowable depreciation is available on the remaining investment assets and they will have a nil value at the end of the project.

(iv) Burung Co uses either a nominal cost of capital of 11% or a real cost of capital of 7% to discount all projects, given that the rate of inflation has been stable at 4% for a number of years.

(v) Interest is based on Burung Co’s normal borrowing rate of 150 basis points over the 10-year government yield rate.

(vi) At the beginning of each year, Burung Co will need to provide working capital of 20% of the anticipated sales revenue for the year. Any remaining working capital will be released at the end of the project.

(vii) Working capital and depreciation have not been taken into account in the net present value calculation above, since depreciation is not a cash flow and all the working capital is returned at the end of the project.

It is anticipated that the project will be financed entirely by debt, 60% of which will be obtained from a subsidised loan scheme run by the government, which lends money at a rate of 100 basis points below the 10-year government debt yield rate of 2·5%. Issue costs related to raising the finance are 2% of the gross finance required. The remaining 40% will be funded from Burung Co’s normal borrowing sources. It can be assumed that the debt capacity available to Burung Co is equal to the actual amount of debt finance raised for the project.

Burung Co has identified a company, Lintu Co, which operates in the same line of business as that of the project it is considering. Lintu Co is financed by 40 million shares trading at $3·20 each and $34 million debt trading at $94 per $100. Lintu Co’s equity beta is estimated at 1·5. The current yield on government treasury bills is 2% and it is estimated that the market risk premium is 8%. Lintu Co pays tax at an annual rate of 20%.

Both Burung Co and Lintu Co pay tax in the same year as when profits are earned.

Required:

(a) Calculate the adjusted present value (APV) for the project, correcting any errors made in the net present value estimate above, and conclude whether the project should be accepted or not. Show all relevant calculations. (15 marks)

(b) Comment on the corrections made to the original net present value estimate and explain the APV approach taken in part (a), including any assumptions made. (10 marks)

【题目描述】

第 9 题为了保持物价总水平的稳定,国家实施宏观调控可以采取的货币政策手段不包括()。

| 【我提交的答案】:C |

| 【参考答案与解析】: 正确答案:C |

答案分析:

提高法定存款准备率使得银行得到的存款提交给央行的准备金增加,可贷资金减少,从而抑制投资,达到调节目标。调整再贴现率和存款准备金率等手段都是宏观调控的货币政策手段。政府为实现价格管理政策目标而实施物价补贴,不是宏观调控的货币政策手段。

【我的疑问】(如下,请求专家帮助解答)

什么是再贴现率

决于这是国内战争还是世界大战?

What will happen to the trade balance and the real exchange rate of a small open economy when government purchases inerease, such as during a war? Does your answer depend on whether this is a local war or a world war?

如果结果不匹配,请

如果结果不匹配,请